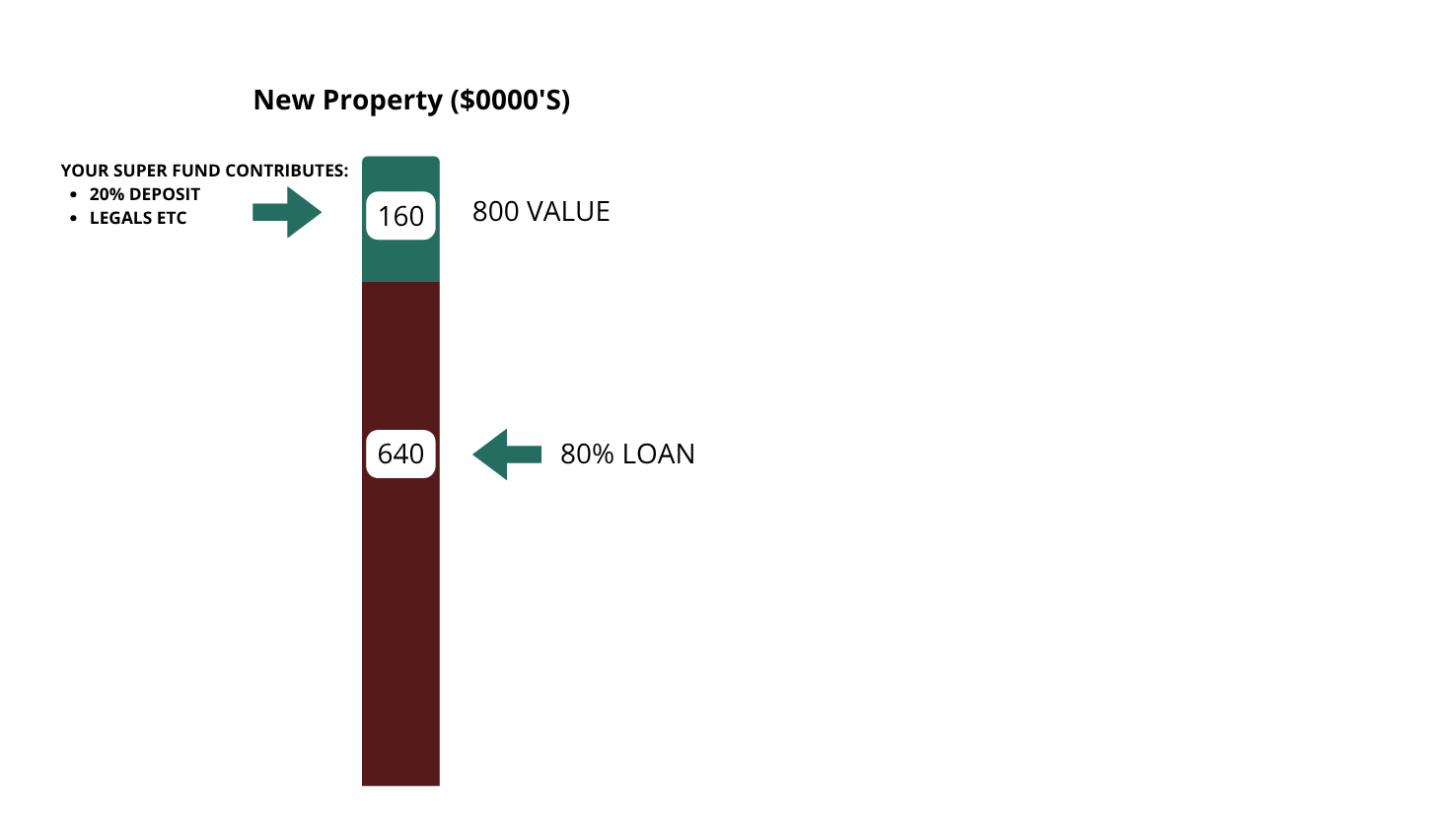

This is how it looks in practice. This is all a very simple process without the same intrusive credit checks.

The real question is:

Is it better to wait for $160,000 to double ($320,000) or for $800,000 to double ($1.6M)?

That’s it – it’s that simple.

Our core business Canterbury Property Services was established in 1980. It’s virtually impossible for any $160,000 portfolio to outperform a $800,000 property over the long term. We have created many millionaires – often in periods of less than 5 years – often starting with little or no money of their own.

See website: www.canterburyservices.com.au

This new technique to accumulate larger superannuation assets (not otherwise possible) is a most powerful wealth creation tool.

Despite being such a new product, hundreds of thousands of Australians have already made a start.

If this system is used to its maximum benefit, it is possible to have up to a dozen properties working for you within 10 years.

And this is after just one 20% deposit on the first property only.

However just 4 properties would represent say $3.2M in assets in today’s values.

Once again, is it better to have $160,000 growing on your behalf or $3.2M growing on your behalf?